The Government of India has made it mandatory for all citizens holding a Permanent Account Number (PAN) to link it with their Aadhaar number. This initiative aims to eliminate fake or duplicate PANs and improve the overall transparency of financial transactions. With a final deadline set and penalties applicable for delays, it is essential for all individuals to complete the linking process promptly.

Summary Table: PAN-Aadhaar Linking at a Glance

| Topic | Details |

|---|---|

| Mandatory Requirement | Yes, for all PAN holders |

| Final Deadline | June 30, 2024 |

| Penalty Charges | ₹1,000 if linked after July 1, 2022 |

| Required Documents | PAN, Aadhaar, Mobile number (linked with Aadhaar) |

| Online Linking Portal | https://www.incometax.gov.in |

| Payment Portal | https://www.tin-nsdl.com (Challan 280) |

Why PAN-Aadhaar Linking is Important

The linking of PAN with Aadhaar has become a cornerstone in India’s digital and financial governance. This measure helps:

- Prevent tax evasion

- Eliminate multiple or fake PANs

- Simplify e-filing of Income Tax Returns (ITR)

- Enable seamless Know Your Customer (KYC) verification

- Ensure accurate tracking of financial transactions

As per the Income Tax Act, linking PAN and Aadhaar is now essential for processing of ITRs and availing tax benefits.

Deadline for PAN-Aadhaar Linking

The government had previously extended the PAN-Aadhaar linking deadlines multiple times, offering ample opportunity for citizens to comply.

Latest Deadline:

- June 30, 2024 is the final date.

Consequences of Missing the Deadline:

- PAN will be rendered inoperative

- Individuals won’t be able to file Income Tax Returns (ITRs)

- Ineligible for refunds or deductions under section 87A

- Higher Tax Deducted at Source (TDS) may apply

- Invalidation of KYC for bank and financial services

Charges for Linking PAN with Aadhaar

Linking PAN and Aadhaar was free until March 2022. However, after that period, penalties apply:

| Timeline | Charges Applicable |

| Before March 31, 2022 | ₹0 (Free) |

| April 1 to June 30, 2022 | ₹500 |

| From July 1, 2022 onwards | ₹1,000 |

Note: Payment must be made via the TIN-NSDL portal under Challan No./ITNS 280 with Major Head 0021 and Minor Head 500.

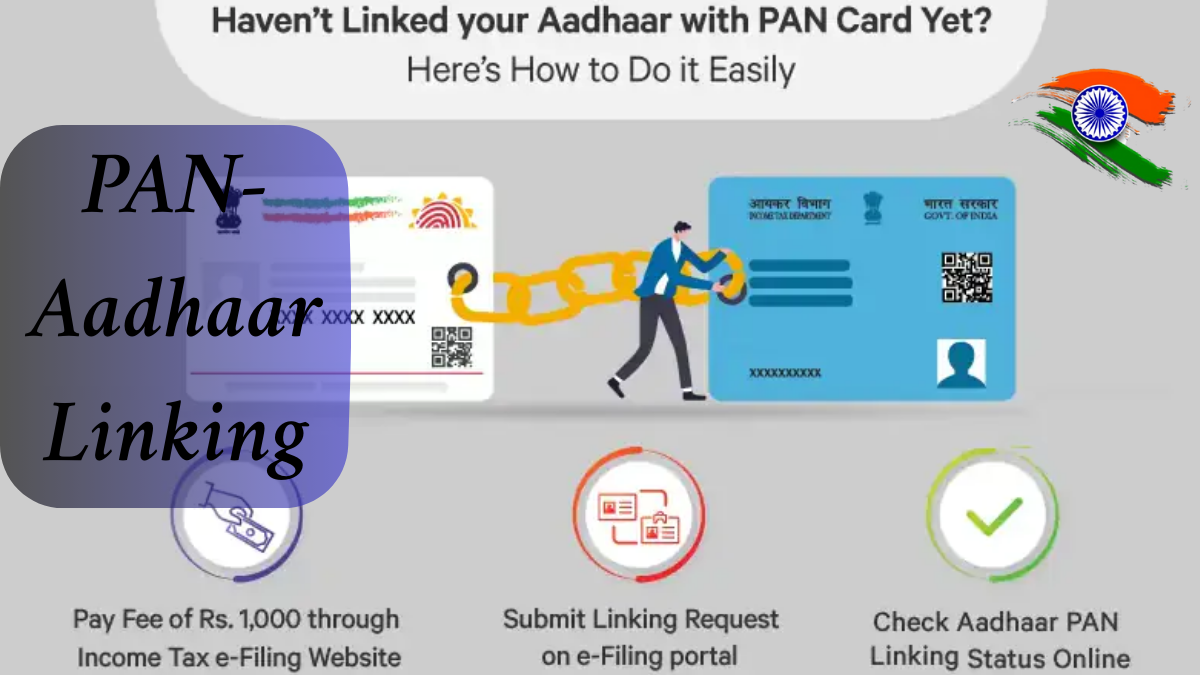

How to Link PAN with Aadhaar Online

The online procedure is user-friendly and accessible 24/7 through the Income Tax Department’s e-filing portal.

Steps to Link PAN and Aadhaar:

- Visit https://www.incometax.gov.in

- Under “Quick Links”, click on “Link Aadhaar”

- Enter your PAN, Aadhaar number, name (as per Aadhaar), and mobile number

- Confirm the details and submit

- Enter the OTP received on your registered mobile number

- Once verified, your Aadhaar will be successfully linked with PAN

How to Check PAN-Aadhaar Linking Status

To confirm whether your PAN is already linked with Aadhaar, follow these steps:

- Visit the Income Tax portal

- Click on the “Link Aadhaar Status” option

- Enter your PAN and Aadhaar number

- The current linking status will be displayed on the screen

What If You Don’t Link PAN with Aadhaar?

Non-compliance can result in a range of penalties and complications.

Consequences Include:

- Inoperative PAN

- Inability to file ITR

- Disqualification from tax benefits and refunds

- Rejection of financial transactions requiring PAN

- Higher TDS/TCS deduction

Common Errors During PAN-Aadhaar Linking and How to Fix Them

| Error Type | Reason | Solution |

| Name mismatch | Different spellings in Aadhaar and PAN | Update details via UIDAI or NSDL portals |

| Invalid Aadhaar number | Typing error | Re-check and re-enter the correct number |

| OTP not received | Unregistered mobile number | Update Aadhaar-linked mobile number via Aadhaar Seva Kendra |

| Payment not reflected | Delay in NSDL systems | Wait for 4-5 days or contact customer support |

How to Pay PAN-Aadhaar Linking Penalty

The ₹1,000 penalty can be paid online as follows:

- Go to https://www.tin-nsdl.com

- Select “Challan No./ITNS 280”

- Choose Major Head 0021 and Minor Head 500

- Enter PAN, assessment year, and contact details

- Pay via net banking, UPI, or debit card

- Save the receipt for future reference

Documents Required

To link PAN and Aadhaar successfully, ensure the following are available:

- PAN Card

- Aadhaar Card

- Mobile number registered with Aadhaar

Frequently Asked Questions (FAQs)

Q1. Is PAN-Aadhaar linking mandatory for everyone?

Yes, all PAN holders must link their Aadhaar unless specifically exempted.

Q2. What happens if my PAN becomes inoperative?

You will not be able to use your PAN for any financial or tax-related activities.

Q3. Can I link PAN and Aadhaar offline?

Yes, by visiting a PAN service center or Aadhaar Seva Kendra, though online is faster.

Q4. Can I update my Aadhaar details online to resolve mismatch?

Yes, certain updates can be made online via the UIDAI portal. For biometric updates, visit a physical center.

Q5. Is there any exemption from PAN-Aadhaar linking?

Yes, NRIs, residents of Assam, Meghalaya, Jammu & Kashmir, and senior citizens above 80 may be exempt.

Conclusion

With the June 30, 2024 deadline fast approaching, linking PAN with Aadhaar is not only essential but urgent. The process is quick and can be done online with minimal documents. Given the serious consequences of non-compliance — including inoperative PAN, penalties, and blocked access to financial services — every PAN holder should ensure their Aadhaar is linked well before the deadline. Don’t wait until the last minute. Act now to stay compliant and avoid future inconveniences.

Official Linking Portal: https://www.incometax.gov.in

For More Information Click Here